Automobile donations are tax deductible. You may commonly deduct your vehicle’s benefit whenever you contain your donation inside your charitable contribution deduction.

They setup the tow business, the tow business the sent to us the gentleman we incredibly Specialist and well mannered Generally appreciate donating to veterans charities Automobiles for Veterans created the process so easy. As soon as I built the choice to donate, they promptly contacted me to choose up the car or truck “Autos For Veterans did an great occupation from the beginning to the end! They ended up Tremendous responsive at the time of inquiry until finally the ultimate get day.”

Note that a charity has up to three decades to promote your automobile. So If your charity programs to offer as an alternative to use it, it's essential to wait for the sale before deducting the charitable donation out of your taxes.

In just a few uncomplicated measures, you might have your donation comprehensive and become rewarded with tax relief payment to your attempts. Step one would be to simply call Auto Donation Facilities on (877) 312-7850 to talk you thru the process comprehensive.

Angle down icon An icon in The form of the angle pointing down. In case you donate a car to charity, you may be able to deduct its worth on the tax return. triloks/Getty JUMP TO Area Chevron icon It implies an expandable section or menu, or in some cases previous / subsequent navigation choices. Introduction to car or truck donation How to define motor vehicle donation facilities in your area Methods to donate your car What happens to donated vehicles?

In addition, whether the charity sells or employs it, if the value of the automobile is a lot more than $five hundred, the IRS involves the charity to report the donation by completing a Type 1098-C or created acknowledgment, which need to incorporate:

The donor can remain answerable for the motor vehicle. This implies liable to the customer And perhaps liable for the actions of the customer if the auto isn't correctly transferred.

I donated my motor vehicle for The 1st time at any time plus they walked me via everything. An extremely enjoyable expertise. Would donate to them all over again!

Regardless of the complexity of The problem, or how much time it requires, We're going to continue to comply with up, seek out out probable avenues, and go after various choices right until an answer is identified. We go the additional mile.

Donate a car or truck and when it sells for under $five hundred you might take a tax deduction equal into the 'truthful market place price' of the donation as much as $five hundred. Reasonable Industry Value is stated because the "Blue read more Guide" or "Guideline Ebook" value of your car or truck.

They setup the tow business, the tow organization the despatched to us the gentleman we pretty professional and well mannered Normally like donating to veterans charities Motor vehicles for Veterans built the procedure really easy. Once I built the choice to donate, they quickly contacted me to choose up the automobile “Vehicles For Veterans did an great occupation from the beginning to the top! website They ended up super responsive at time of inquiry until finally the final pick up day.”

As an alternative to providing or investing in your made use of car or other car, look at donating it on the American Most cancers Culture. We obtain top scores as an automobile donation get more info charity.

What types of vehicles does Cars and trucks for Residences settle for? Don’t here Permit the identify fool you. We acquire in many different vehicle donations that roll and float, even when they are retired from use. Find out more

A: Donating an auto or other motor vehicle to charity could be a confusing final decision. A lot of charity vehicle donation courses guarantee to website help the charities but are operate by third-get together processors that return little or no on the charity.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Ariana Richards Then & Now!

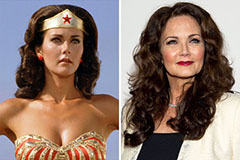

Ariana Richards Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!